What is an ICP for Sales? Everything You Need to Know

Nothing breaks down your sales engine like poor targeting. No matter how skilled your reps or what sales methodology you use, you can’t close someone who has no need for your product or service.

To get super narrow on the types of prospects you need to speak to, you need well-developed sales ICPs (ideal customer profiles).

Sales ICPs use quantitative data to determine the firmographic signals (such as company size, industry, and revenue) that indicate an ideal company to target. It’s the company version of a buyer persona.

In this article, you’re going to learn how to create a revenue-driving sales ICP, and then put it into practice to improve sales targeting and drive conversion rates.

What exactly is an ICP in sales?

The ICP sales acronym stands for Ideal Customer Profile. It’s an acronym used by both sales and marketing teams and refers to the firmographic, behavioral, and environmental qualities of an account (read, company) that you’d expect to be your most valuable customer.

ICPs are all about sales targeting. To be successful in B2B sales, you need to understand which types of businesses represent the most value, so you can focus on the most important opportunities first.

Think about it like this. Let’s say you’re an Account Executive at an email marketing software company. You’ve got a bunch of different customer types in different industries:

- Entrepreneurs and startups

- Small business owners

- Ecommerce websites

- SaaS companies

- Media sites

- Solopreneurs, YouTubers, and bloggers

- Real estate agents

- Retail

- Education

- Financial services

- Sales organizations

You know that each of these potential customers has different needs, challenges, and expectations. In order to sell to them, you need to have a deep understanding of these goals and pain points and how to connect with them.

More than that, you need to know which of the above you should be going after when prospecting for new accounts. Is a real estate agent more likely to close than a small business owner? And how does their industry/size impact expected contract value, retention, and LTV (customer lifetime value)?

Your sales ICP takes all of these factors into account and says:

“Of all the kinds of customers we could be targeting, these are the kinds that will be most valuable to our long-term success. Here are the attributes that define them.”

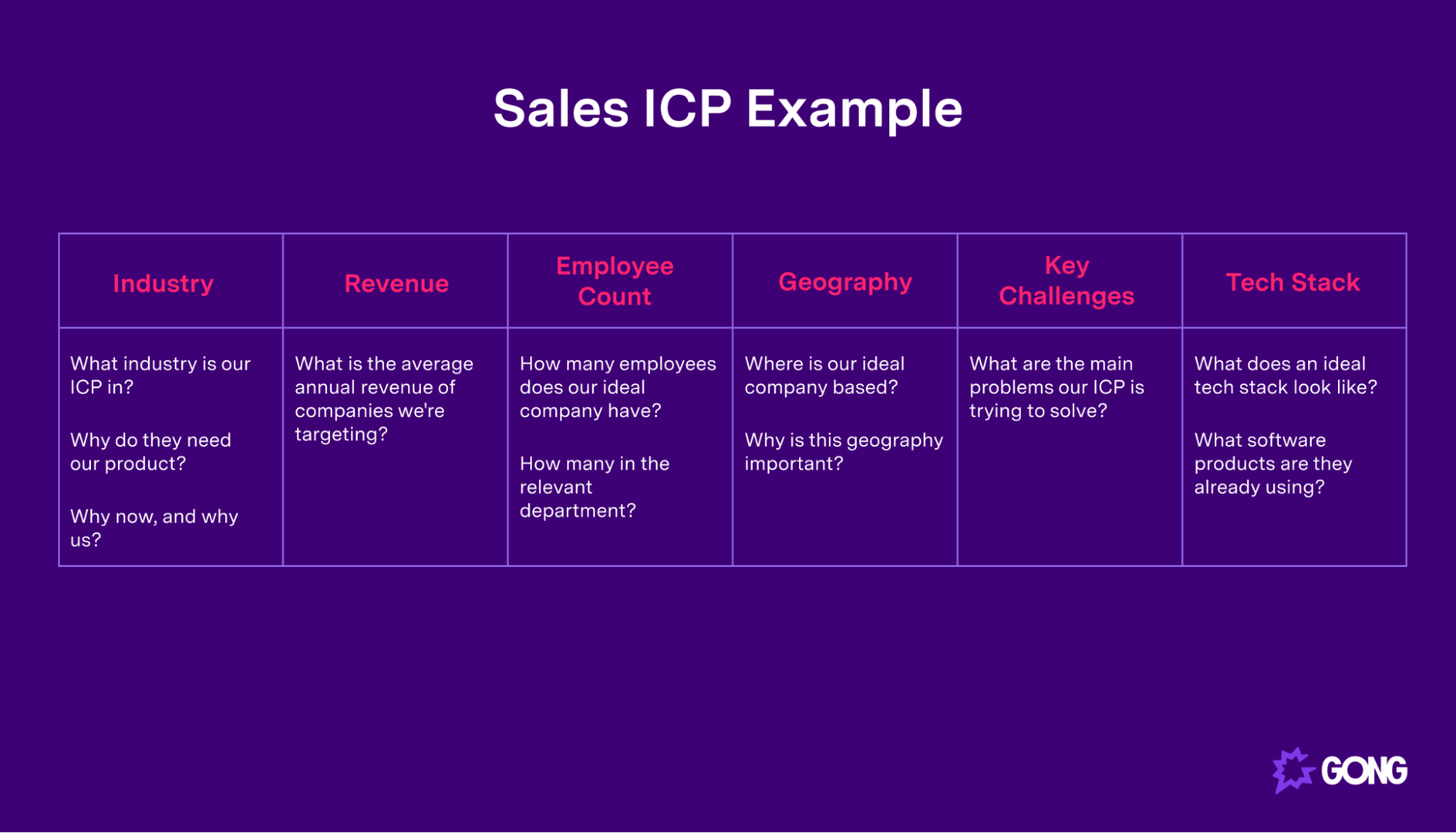

The typical sales ICP looks something like this:

Sales ICPs vs. customer personas — what’s the difference?

Whenever the topic of sales ICPs comes up, there’s always someone in the team that asks:

“What do we need this for? Don’t we have customer personas already?”

The thing is, sales ICPs and buyer personas aren’t the same thing.

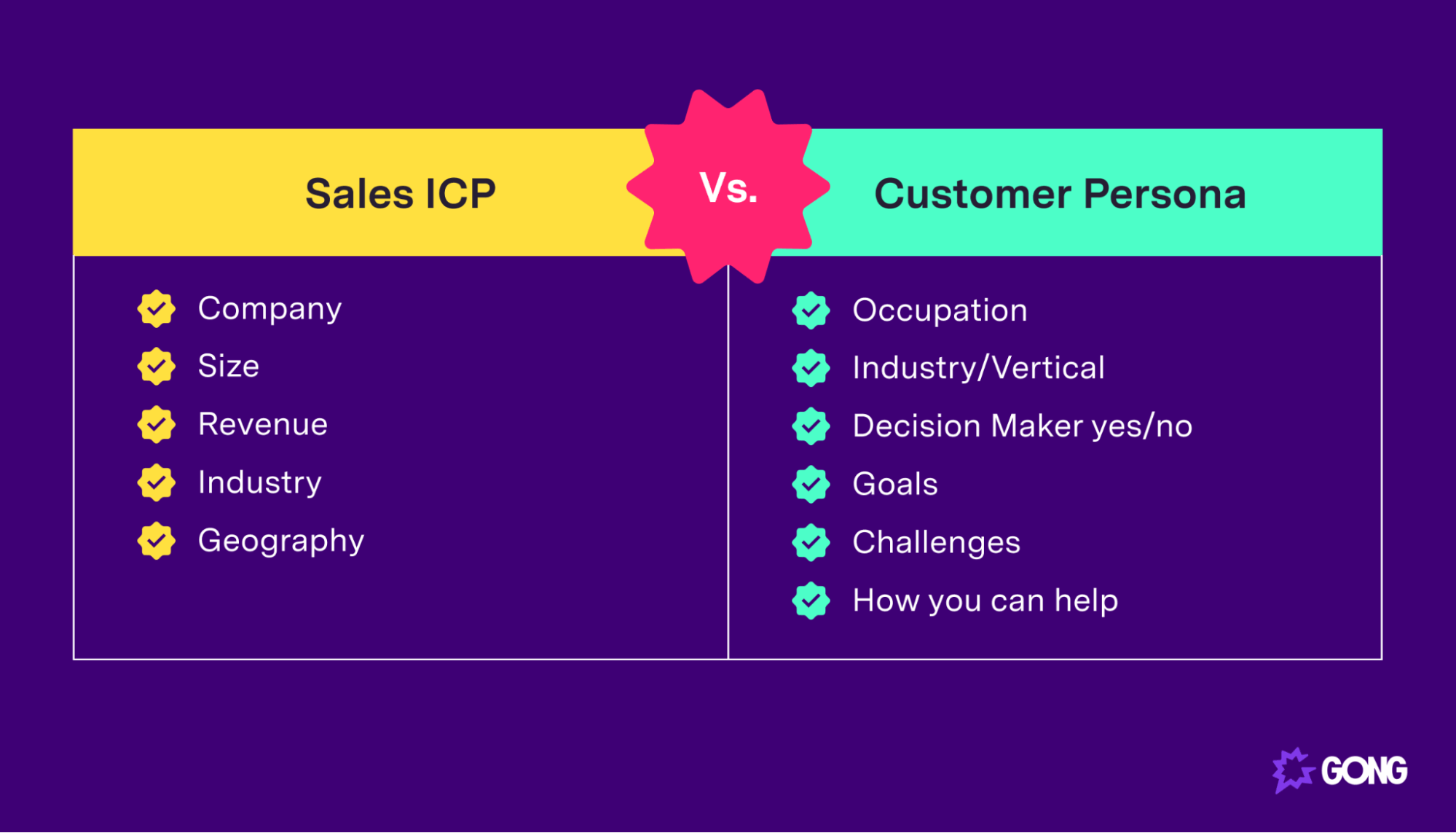

The distinction is quite simple: ICPs are about companies, and personas are about people.

Your Ideal Customer Profile looks at largely quantitative aspects such as company industry, annual revenue, geography, and number of employees. You’ll use it to identify which companies to go after (we’ll get into the nitty-gritty on how to actually do that a little later).

Buyer personas (also known as customer personas and marketing personas) describe the people within our ideal company.

These are the people we need to speak to get a sale across the line, meaning personas need to be a little more qualitative, including details such as:

- Pain points and challenges

- Job title

- Role within the sale

- Organizational and role-based goals and objectives

- How your product helps them succeed

It’s not a case, then, of choosing the buyer persona or ICP framework. To succeed, you need both.

Why create a sales ICP in the first place?

So, what’s the point of building an ICP to begin with? Isn’t it better to cast the net wide and just catch everything you can?

Well, no, not really. Let’s look at why.

Use messaging that lands with specific buyers

When you’re intimately familiar with the types of companies you’re targeting (based on factors like buying history, average purchase value, etc.), you’re going to get really good at identifying and speaking to the pain points these buyers have, and your sales conversations are going to be highly targeted to those who need your product most.

The more accurately you can describe buyers’ situations, the better of a fit they’ll feel that your solution is. Plus,

Faster sales cycle + higher win rates

If you stick to targeting companies that meet your ICP, your sales cycle becomes faster, and you’ll usually see much higher win rates.

That’s because each of your customers fit a similar profile and have a unique need for your product. Buying committees look largely the same (meaning the decision-making process is similar), and you become skilled at communicating the key value props that resonate with this kind of buyer.

Focus on higher-value accounts

One of the biggest factors we look at when designing a sales ICP is average contract value (ACV).

Basically, we ask, “Which types of businesses hold the biggest contracts with us?”

The logic is simple. Why spend 20 hours selling to a $100k account, when you could spend the same amount of time selling to a $300k account?

Once you’ve developed your sales ICPs, you’ll be able to spend more time on fewer accounts, and focus on building strong, long-term relationships with your most valuable customers (driving loyalty and maybe even gaining a few referrals along the way).

Faster qualification

Using sales ICPs doesn’t mean you’ll only sell to the one type of customer you identify. You’ll still attract leads from all industries and verticals, and it’s not as if you’re going to turn that revenue away because the company doesn’t fit your ideal customer profile.

You can, however, use the signals you’ve identified in building your ICP (such as company revenue, industry, and maturity) to score and prioritize leads in your sales engagement platform and allocate sales resources and ABM (account-based marketing) spend accordingly.

In short: if prospects fall outside of your ICP (i.e. they aren’t a good fit), you’ll know real fast by asking tailored qualifying questions, giving you the ability to focus your time and energy on the deals that are most likely to convert.

Creating a revenue-driving sales ICP in 4 steps

So, pretty good framework, but how do you actually create a sales ICP?

1. Define the end result

Before you start looking at any customer data, running interviews, or even putting any ideas down on paper, it’s crucial to understand what your end result is going to look like.

Defining the categories in your sales ICP beforehand (things like employee count and company revenue) will help you keep the research process on track and prevent you from wasting time on factors that don’t truly impact your ICP production.

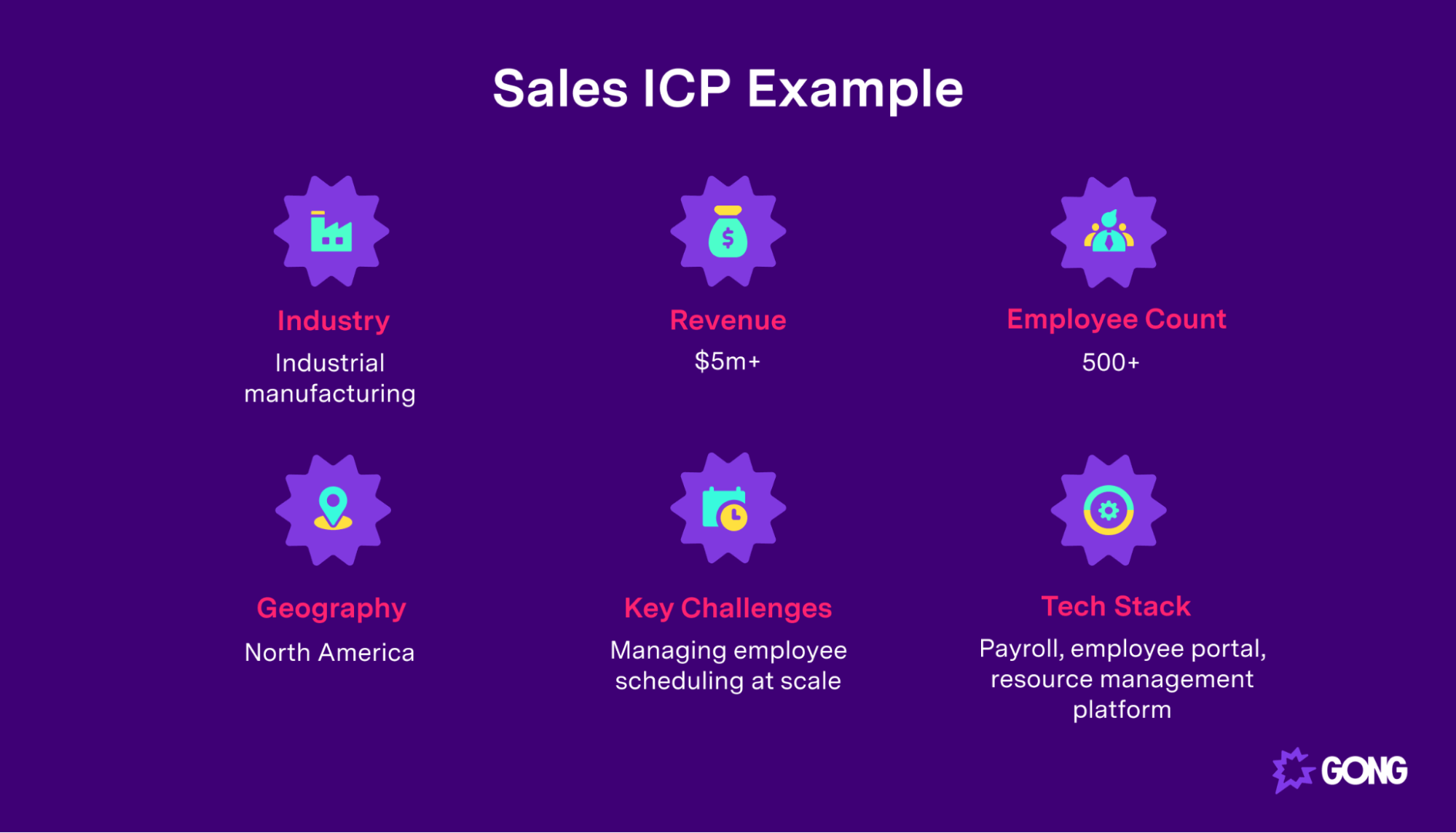

Here’s an example of what a finished product might look like, for a bit of inspiration.

2. Review and analyze current customer data

Now you know what you’re looking for, it’s time to dive deep into your customer data.

Here, you’re going to pull data from your CRM, sales intelligence platform, reporting center, whatever you use, and wherever you can get it.

Start by filtering your customer base by revenue (i.e., pull out the highest value accounts). Analyze factors such as:

- Typical contract lengths

- Annual company revenue

- Product and feature adoption

Does anything stand out? For example, perhaps your biggest accounts all make over $4.5m in revenue and have 400+ employees.

You’re essentially looking for trends and common characteristics. Other areas to dig into include:

- Industry

- Problems and pain points

- Geography

- How many employees and users they have

3. Organize customer interviews to supplement data

For the most part, ideal company profiles should be data-driven, meaning you can rely pretty heavily on the data you already have.

You might, however, find value in running customer interviews to supplement with some of the info you don’t already have. Ask about:

- Their tech stack (what else are they using)

- Key challenges they’ve been facing, and how they’re using your tool to fix them

- Employee count by team

4. Document and prioritize important attributes

The last step is pretty straightforward. You’re just going to collate all of the data you’ve collected, pull out key insights, and present it in a format similar to what we looked at above.

The idea here is to be concise. Your sales team doesn’t need pages and pages of information. ICPs should be key, high-level takeaways, such as “Recruitment firms in North America with 200+ employees.”

Putting your sales ICP into practice

Many sales teams fall short with ICPs because they create them, then file them away somewhere in a (not-so-well-organized) folder structure.

For ICPs to make a difference, you must use them to inform your actual sales practices.

1. Build dedicated prospecting sequences

Prospecting should never be a one-size-fits-all process.

However, we salespeople do have an interesting dilemma. We want to personalize efforts as much as possible, but in order to do this work at scale, we need to take advantage of templates and automation.

ICPs allow us to find the ideal middle ground.

Using the ideal company profiles you’ve created, develop custom outreach messaging to fit each use case more closely and increase the relevance of your communications.

For instance, your initial cold email might look different for two different ICPs, each including industry-specific social proof, and covering a different pain point that’s most relevant to that specific profile.

2. Create industry-specific sales materials

Sales materials (demos, customer stories, and slide decks) should be targeted to each ICP you create to increase effectiveness, engagement, and conversion.

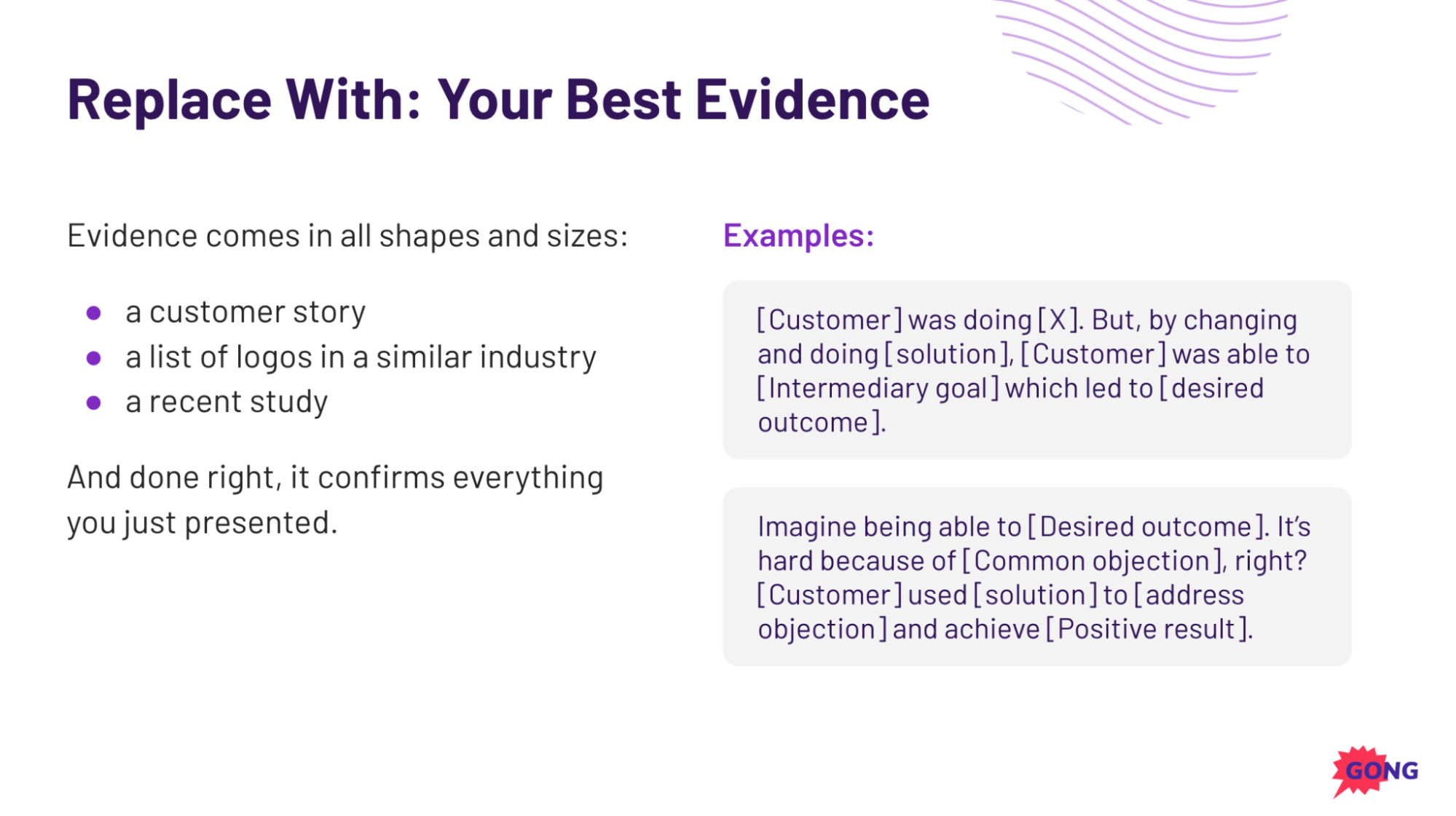

Take this sample slide from a Sales Deck Template.

In this slide, the sales rep piles on the social proof by telling a customer story, supplemented by compelling graphs and other visuals.

Using your ICPs, customize these slides by industry and vertical.

3. Build industry-specific sales enablement programs

One of the things you’ll find through this creation process is that your common competitors will differ by ICP.

For instance, you might compete with different products for enterprise-level customers than for startups, though you may have an ICP for both (for different reasons).

With this knowledge in hand, you can create industry-specific sales enablement programs. Examples include:

- Creating battle cards for the companies you compete with in each industry

- Training reps on demo flows and talk tracks to address industry-specific pain points

- Developing a database of best calls to buyers in that industry

4. Identify key buying signals for your ICP and set up automated alerts

Use your revenue intelligence tools to identify buying signals for each ICP, then build automated alerts to notify reps of when to act.

For example, you might determine that a VP from a target company posting on LinkedIn about a specific issue qualifies as a buying signal.

Or, you might look more broadly at activity throughout the sales pipeline.

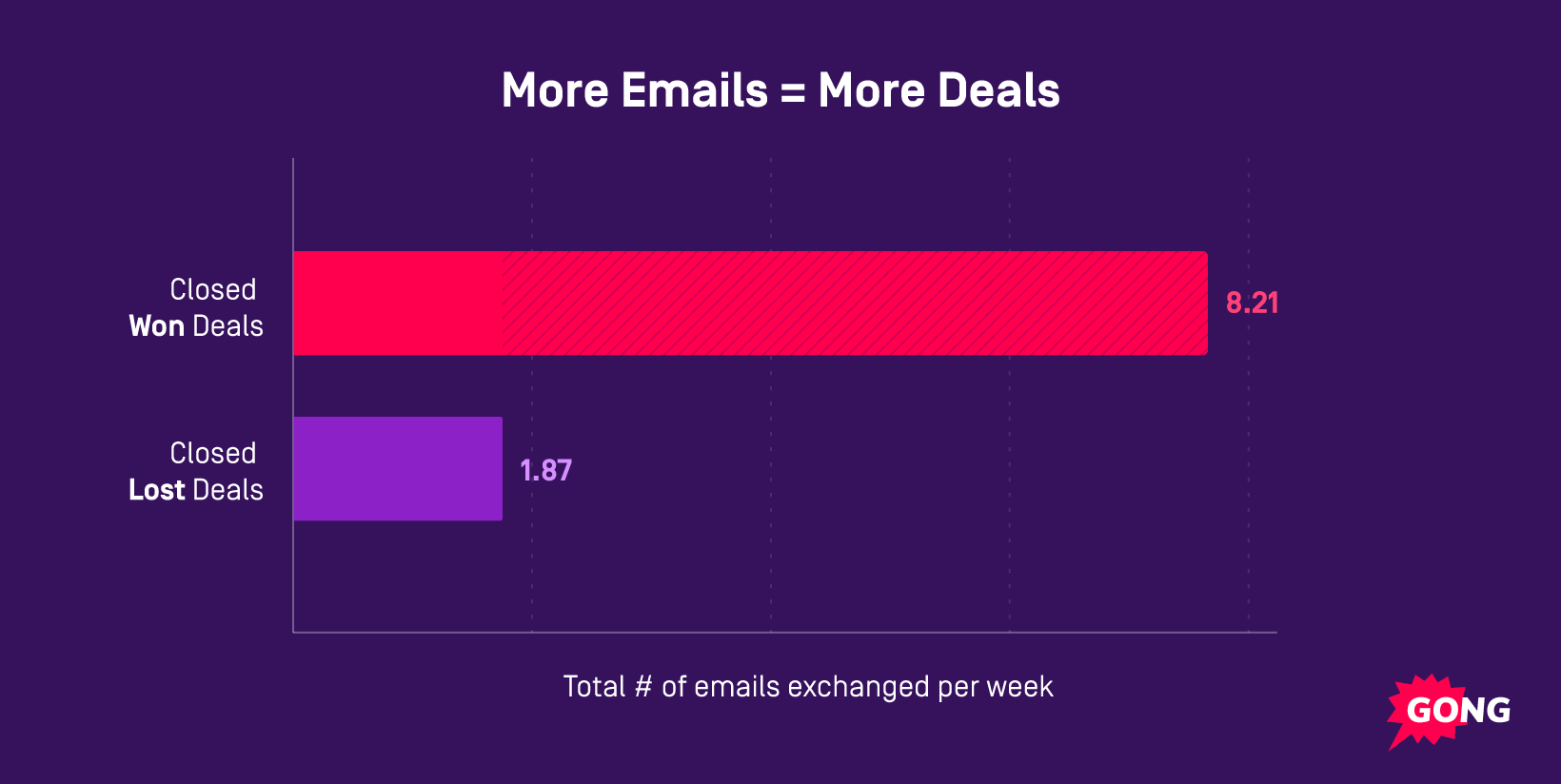

For instance, Gong Labs identified that across the board, engagement with sales emails is a powerful buying indicator.

5. Build a lead scoring system based on ICP benchmarks

Your ICP data can also be used to inform lead scoring characteristics to prioritize inbound sales efforts.

For instance, you could set up a scoring system based on each of the following ICP requirements:

- Industry (1 point for an industry match)

- Employee count (3 points for 200+ employees, 2 points for 100+ employees, 1 point for below 100 employees)

- Revenue (1 point for every $1m in annual revenue)

Conclusion

Nothing is worse than wasting your time selling to a dead lead. You get three calls in only to discover that “they don’t have the budget.”

ICPs can help with that. Sales ICPs are crucial for identifying high-value prospects, and helps you focus more time on those to builder stronger, long-term customer relationships (and of course, close more big deals and boost your bottom line).

But, ICPs shouldn’t be viewed in a vacuum; they must be used as a part of a comprehensive sales strategy.

Use your sales ICPs to kick-start your revenue growth with our High-Growth Sales Strategy Template.